Investor Education

How THRV Approaches Income

THRV is a flexible, “go anywhere” actively managed multi-asset income strategy that seeks to make monthly distributions and generate an attractive current level of income relative to prevailing intermediate-term U.S Treasury yields . Our strategy anchors the portfolio to a core allocation of fixed income ETFs which provide diversification, liquidity and broad exposure across maturities and credit qualities. As a foundation we believe these positions offer efficient access to segments of the bond market across the yield curve that can provide meaningful current income. Around this foundation, the fund tactically allocates to closed-end funds (CEFs), dividend-paying equities, preferred shares, real assets, and commodities each carefully selected to enhance yield, diversify risk, and add resilience against inflationary pressures.

Additionally, the strategy maintains a systematic derivatives overlay intended to help manage downside risk, with initial entry positions ranging from 0.05%-0.25% of the portfolio in put options at any given time. This hedge is scalable up to 10% in periods of heightened volatility to help cushion drawdowns and preserve capital.

The derivatives overlay is intended to help manage downside risk; there is no assurance it will be effective or reduce losses. Derivatives involve additional risks, including leverage, imperfect correlation, liquidity/pricing risk, counterparty/clearing risk, and the risk that options may expire worthless. The use of derivatives may increase volatility and/or detract from performance.

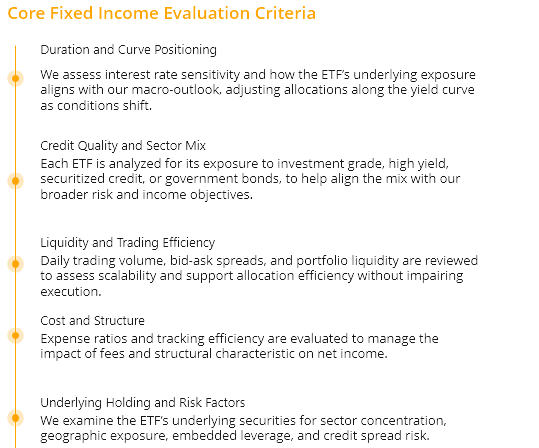

Our Core: Fixed Income ETFs

The foundation of the portfolio is a diversified allocation (40–70%) to fixed income ETFs. These instruments provide transparent, liquid access to exposure across the bond market, allowing the investment team to actively manage duration, credit quality, sector mix, and curve positioning. By using ETFs as the core, the strategy is intended to balance implementation discipline with tactical flexibility, allowing the portfolio to adapt to evolving macro and interest rate environments.

Building Around The Core

The Role of Complementary Allocations

We construct the remainder of the portfolio with a tactical mix of income-oriented assets that complement our ETF core. These include CEFs, dividend-paying equities, preferred securities, commodities, and real estate assets. These allocations are intended to:

-

Our rotating core complements are tactical, intending to expand yield potential and portfolio resilience

-

Balancing factors across yield generating assets with total portfolio risk delivers multiple uncorrelated income streams, which may enhance durability of monthly distributions.

-

We systematically adjust our exposure and core positions based on current macro and market conditions across all asset classes and sectors

Tactical Yield Enhancement

Beyond the Core: How We Think About Each Sleeve

-

CEFs can provide access to differentiated income-oriented exposures, but they also involve additional risks (including leverage, discounts/premiums to NAV, and liquidity considerations) and require careful diligence on structure and underlying holdings.

-

The Fund may opportunistically increase exposure to equities exhibiting improving fundamentals or supportive price trends, particularly when consistent with the portfolio’s income and risk objectives. Equity investments involve market risk, including potential loss of principal, and dividends may be reduced or eliminated.

We generally seek to avoid concentrated exposure to high-beta equities and may emphasize areas where yield appears more strongly supported by company fundamentals, subject to prevailing macro and interest-rate conditions.

-

We use preferred securities to capture attractive yields that sit between traditional bonds and common equity in the capital structure. Preferred securities can be sensitive to interest rates, issuer credit quality, and liquidity conditions, and they may be volatile.

-

This exposure is calibrated carefully designed to enhance yield and diversification without adding excessive FX or political risk. It’s particularly useful in environments where U.S. dollar strength begins to fade or when global equity markets offer better value than domestic names.

-

Commodities, particularly via income-generating structures like royalty trusts or certain commodity-linked equity funds, play a selective but important role.

How We Think About Risk Management

-

The Fund may maintain a modest, systematic derivatives overlay as part of its risk management process. Establishing hedges before volatility rises can sometimes improve implementation flexibility and pricing, but there is no assurance the overlay will be effective or reduce losses, and it may limit gains or detract from performance. Our opening budget targets ~10-15% of notional equity exposure across the entire portfolio

-

We purchase put options on the S&P500 for equity exposure. For interest rate and credit risk we buy puts on single ETFs that carry sensitivity to rates or credit, subject to available market depth (open interest) and positioning.

-

The derivatives overlay may be increased when the Adviser’s systematic risk signals indicate elevated market stress such as rising volatility, widening credit spreads, or deteriorating liquidity conditions. Position sizing may also consider option pricing and market structure.

-

A hedging overlay may help manage downside risk in certain markets, but it cannot eliminate losses and may limit gains or detract from performance, particularly during strong rebounds.

-

Overlay implementation is managed with defined position sizing and tenor limits, with attention to expected hedge carry, liquidity conditions, and gap risk. Actual costs and results may vary.

While the overlay seeks to manage volatility and reduce downside participation, there can be no assurance that the use of derivatives will be effective, and the Fund may experience losses or underperformance due to adverse market conditions or implementation risk

ETF Mechanics (Creation Redemption)

Strategic Efficiency Through ETFs

-

You trade THRV on the exchange; authorized participants (APs) handle creations/redemptions in large “creation units”

-

Where feasible, in-kind baskets can reduce realized gains within the portfolio

-

Active ETFs like THRV may use custom baskets to manage exposures and push out low-basis or short-term positions, supporting tax efficiency over time

-

Daily holdings and the ETF structure allow us to adjust sleeves while maintaining liquidity.

Why We Use Closed End Funds

Understanding Closed End Funds (and why we are selective)

The tactical tilt of the portfolio may include a concentrated allocation (generally 20–30%) to closed-end funds (CEFs). CEFs can provide access to differentiated income-oriented exposures, but they also involve additional risks (including leverage, discounts/premiums to NAV, and liquidity considerations) and require careful diligence on structure and underlying holdings.

We evaluate CEFs across several dimensions before they’re included in the portfolio:

-

We evaluate funds trading at discounts or premiums to NAV and consider the persistence and drivers of those valuations (e.g., leverage, sector exposure, distribution policy, and investor positioning). We also evaluate whether a fund’s current valuation is consistent with its historical trading range and underlying fundamentals.

-

High distribution rates can involve additional risk. We evaluate not only current distribution levels, but also coverage metrics, earnings power, distribution sources (income, capital gains, and/or return of capital), and the fund’s distribution policy. We focus on funds where distributions appear more strongly supported by portfolio income and total return drivers, recognizing that distributions may change over time and are not guaranteed.

-

We evaluate the structure and use of leverage, particularly in rising-rate environments, including borrowing costs, leverage terms, and asset coverage. Funds with high borrowing costs or aggressive leverage may be avoided or position-sized accordingly

-

Both market liquidity (daily volume and bid/ask spreads) and portfolio liquidity are reviewed. We generally favor funds with sufficient liquidity to support efficient implementation and risk management, and we may limit exposure to thinly traded CEFs that could become difficult to exit during periods of market stress.

-

We examine the CEF’s holdings and risk exposures, including sector concentration, credit quality, duration/spread risk, geographic mix, and any embedded leverage or derivatives exposure

Key Features of Closed End Funds

-

Shares are not created or redeemed daily; they trade on exchanges

-

CEFs often trade at prices above or below their Net Asset Value (NAV)

-

Many CEFs borrow capital to increase income potential, amplifying both returns and risks

-

High distribution rates can involve additional risk. We evaluate not only current distribution levels, but also coverage metrics, earnings power, distribution sources (income, capital gains, and/or return of capital), and the fund’s distribution policy. We focus on funds where distributions appear more strongly supported by portfolio income and total return drivers, recognizing that distributions may change over time and are not guaranteed.

-

Shares can be bought or sold anytime during market hours, however some Closed End Funds have low liquidity increasing the risk

-

Portfolio managers actively select holdings and manage risk. In less efficient or complex markets (e.g., emerging market debt, high-yield bonds), active management has the potential to add significant value compared to passive strategies. However, it does not guarantee better performance.

Distributions and Taxes

Monthly Distributions and What They Mean

THRV seeks to pay monthly distributions. The amount can vary and isn’t guaranteed. Distributions may include ordinary income, qualified dividends, capital gains, and/or return of capital (ROC). Your Form 1099-DIV will break this out each year.

Consult a tax professional; individual situations vary

Key Risks to Consider

Market & Equity Risk: Prices can decline; hedges may not offset losses.

Interest-Rate & Credit Risk: Bond prices fall as rates rise; credit spreads can widen.

CEF-Specific Risks: Leverage, discount volatility, manager risk, and potential liquidity constraints.

Derivatives Risk: Options can lose value; hedging may reduce upside or be unavailable at desired costs.

Allocation Risk: Tactical sleeve sizing may help or hurt outcomes depending on conditions.

Operational/Trading: Bid/ask spreads, premiums/discounts, and market stress can impact execution.

Please see prospectus for full risk disclosures

-

The Fund may use a systematic derivatives overlay help manage downside risk and adjust portfolio exposure during periods of elevated market volatility. Under normal market conditions, the overlay is typically modest (ranging between 0.05-0.25% of portfolio value) and may be increased potentially up to 10% based on the Adviser’s risk signals and prevailing market conditions. Instruments may include equity index or ETF put options and, in certain circumstances, volatility-linked options (such as VIX-related call options). There is no assurance the overlay will be effective or reduce losses, and it may limit gains or detract from performance

-

No. The Fund seeks to pay monthly distributions, but amounts vary and are not guaranteed; distributions may include ROC

-

Selective CEF exposure can add specialized income and discount opportunities, balanced by strict risk and liquidity controls

-

To the extent that we can be, the fund will use In-Kind transfers to lower the impact of realized gains, however income and distributions will be subject to your individual tax situation and type of distributions received

-

The derivatives overlay may be increased when the Adviser’s systematic risk signals indicate elevated market stress such as rising volatility, widening credit spreads, or deteriorating liquidity conditions. Position sizing may also consider option pricing and market structure.

FAQ

Downloads and Contact Information

THRV: Investor Guide

Fact Sheet

Prospectus

Presentation

Please Contact IR@prosperafunds.com for any questions you may have regarding the fund or strategy

Disclosures

SAI

Meet Your Wholesaler

There is no guarantee that the Fund will achieve its investment objective. An investment in the Fund involves a high degree of risk, including the potential loss of the entire investment. The Fund is subject to the risks of its underlying funds in addition to general economic and market conditions. The Fund and its service providers are subject to operational and cybersecurity risks. Past performance does not guarantee future results.

The Fund may use a systematic derivatives overlay implemented using models and quantitative signals developed by the Adviser. The overlay is intended to help manage downside risk; there is no assurance it will be effective or reduce losses, and it may limit gains or detract from performance. Derivatives (including index or ETF put options and VIX-related options) involve additional risks, including leverage, imperfect correlation, liquidity and pricing risk, counterparty/clearing risk, and the risk that options may expire worthless. The use of derivatives may increase volatility and costs.

The Fund seeks to make monthly distributions; distributions are not guaranteed and may change. Distributions may include income, capital gains and/or return of capital. Diversification does not guarantee protection against loss.

ETFs are subject to market risk, including the loss of principal.

Before investing, carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other important information is contained in the Fund’s Prospectus. Please read the prospectus carefully before investing.

Securities offered through Vigilant Distributors, LLC, member of FINRA/ SIPC.

This advertisement does not constitute an offer to sell, nor a solicitation of an offer to buy the securities described herein.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE ON BOTH.